However, the books have only been balanced by a range of measures which include a major review of frontline services and a council tax increase of nearly 5%. KCC has also had to fall back on vital reserves to present a balanced budget for 2024-25, which is something the authority is legally obliged to do.

The budget, which focuses on protecting and prioritising vital services to the most vulnerable people in Kent, was approved by the full Council by 47 votes to 15. One councillor abstained.

The new rate of council tax is equivalent to a £1.47 per week (£76.59 per year) increase for a typical band D household, of which £30.60 per year is for the 2% of council tax which is ringfenced specifically for adult social care services.

A total of eight amendments to the draft budget were put forward and debated, including an alternative budget proposed by the Leader of the Labour Group, Dr Lauren Sullivan, and seconded by Cllr Alister Brady. None of the amendments were passed.

“We are going to have to use a range of measures, some of which will be extremely unpalatable to our residents, if we are to secure Kent’s future.”

KCC Leader, Roger Gough, told councillors that the last-minute additional funding from the government in this year’s settlement was welcomed, but that well-run councils across the UK have never faced such a serious financial situation. He told Members of the Council that it is an inescapable fact that the cost of and demand for key council services for adult social care, children in care, and home to school transport will continue to increase at a much higher rate than the additional funding available from government and local taxes.

“We have lobbied hard, with the support of the County Councils Network and MPs, at meetings with government, in correspondence with the Secretary of State, and in many high profile and frank media interviews, to convey the perilous financial state of local authorities across the UK.

“We are grateful that the government has been willing to listen and do something so unusual as to make extra funding available so late in the settlement process. The extra funding we have received is helpful, but it is not a gamechanger for this budget and has only gone a very small way towards easing the pressure, particularly when we look ahead to the next few years.

“The stark reality is that the extra money from government only represents 15% of the budget gap we have had to fill in order to present a balanced budget today.

“There is no cavalry coming over the hill, this is down to us. The Institute for Fiscal Studies has said that public spending will be extremely tight over the next few years, irrespective of who is in central government.

“We are doing everything we can and there is no escaping from the fact that we are going to have to use a range of measures, some of which will be extremely unpalatable to our residents, if we are to Secure Kent’s future.

“We’ve been through an extensive process to get to where we are today and present a balanced budget for approval. The work does not stop with this budget.”

The initial budget gap of almost £50m in the earlier draft budget, before the Chancellor’s autumn budget and the final local government finance settlement, has been closed with a list of spending reductions and savings which include:

- Planned spending changes – such as reduced costs from renegotiated energy prices, stricter application of eligibility criteria for access to services, and reducing debt costs - £19m.

- Savings and income - additional dividends from our successful trading companies, increasing income from charges, and stronger contract negotiations with suppliers - £11m.

- One-off measures - including use of reserves to buy time to plan for longer term savings, and using sale of assets to fund transformation programmes - £20m.

The one-off actions and use of reserves, particularly in the first year, will reduce the Council’s ability to absorb any future financial shocks. There will also be a need to make recurring savings and cost reductions in the following two years, as these one-off measures in 2024-25 are not a sustainable solution to increased recurring costs.

The most significant pressures include:

- Adult social care - gross £112.8m net (after savings and income) £58.8m

- Children in care - gross £31.4m net (after savings and income) £28.2m

- Home to school transport - gross £34.7m net (after savings and income) £27.5m

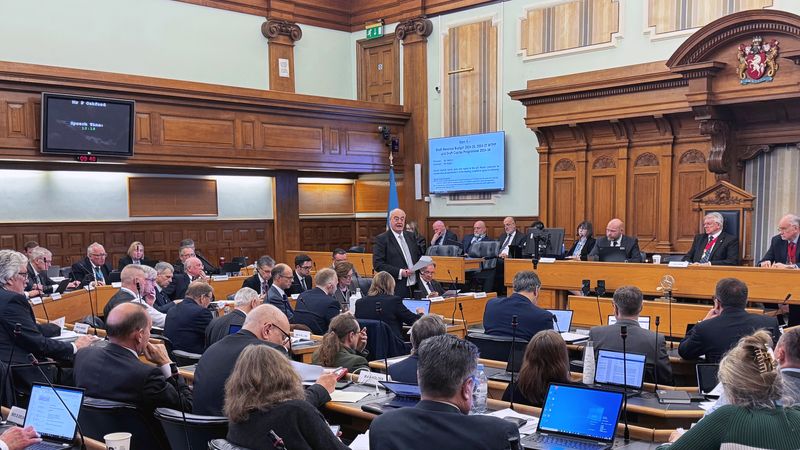

Deputy Leader Peter Oakford addresses the budget meeting

The budget was proposed by Deputy Leader and Cabinet Member for Finance, Corporate and Traded Services Peter Oakford, who said: “When we started this year’s budget process, we needed to find an estimated £118m of savings to balance the books.

“The one-off measures used this year buy us time to find some more permanent solutions. Over the next three years we will have to find equivalent savings if we are to keep our heads above water and avoid bankruptcy.

“Times are tougher than ever. The government has gone some way to addressing the dire financial situation of local authorities across the UK in the local government settlement, but it is nowhere near enough. It means KCC Members have had to vote today on a budget that will see some painful reductions to frontline services, proposes the maximum increase in council tax, and falls back on reserves to ensure that we can balance the books.

“We have been prudent and sought to address the pressures we face. We’re planning for now and the future, so that difficult decisions can be taken with due consideration. We are legally obliged to continue to deliver statutory services, but we also provide many services that are discretionary and, most importantly, add to the quality of life of people living in Kent.

“I don’t think there is a councillor in the country who sought election to take away and reduce services that people value. Until the government adequately funds social care and recognised the pressures that local government is dealing with, these cuts will continue year on year as we strive to survive.”

The spending growth pressures impacting the Council are being experienced by most other councils, and the financial sustainability of local authorities in general is a concern across the UK. The budget approved today takes all the necessary steps to manage future spending within resources available through savings, income and future cost avoidance. However, it doesn’t fully secure the Council’s financial resilience and sustainability in the medium term. Spending pressures are growing at unsustainable levels.

Mr Oakford continued “The government’s last-minute bid to address the structural deficits in adults and children’s services is welcome, but unfortunately it is not enough, and there will still come a point within the medium-term plan period where we are totally unable to balance the budget on a sustainable basis from savings in other spending areas. We are simply running out of services that we can reduce.

“So far, the councils who have declared themselves bankrupt have been unique in that they have all had specific issues and pressures or made poor decisions. But following the outcome of the Autumn Statement and the government’s continuing refusal to listen to, or adequately support, local authorities, even well managed councils like KCC, without any long-term issues, could follow suit. Such is the financial situation we find ourselves in.”

Following today’s vote on the overall budget plan for 2024/25, KCC will be identifying where public consultation may be required for the key saving proposals before any final decisions on implementation.

Further information

A link to a recording of the budget meeting will be available at https://www.kent.gov.uk/about-the-council/how-the-council-works/committees-and-meetings/watch-council-meetings

For more on the budget, visit: https://www.kent.gov.uk/about-the-council/finance-and-budget/our-budget